Being a firm believer in gold as a long term investment as well as a passionate coin collector, I want to share my knowledge in this specific field in numismatics. It outperforms bullion investment and offers the investor several other perks. Read on, I hope you’ll learn something!

What is numismatics?

Most people get this word wrong, and I don’t blame you. Probably the only people that know the real meaning of this word are numismatists!

Wikipedia: Numismatics is the study or collection of currency, including coins, tokens, paper money, and related objects.

What is semi-numismatic gold?

Semi-numismatic gold coins have both numismatic and bullion value. This may sound simple enough, but as you will soon understand, this combined value offers insurance and leverage at the same time, outperforms pure gold bullion holdings in the long run and should be regarded an investment class in its own right, one that deserves any serious investors’ special attention.

Great example of semi-numismatic gold is this Queen Victoria 1881 full gold sovereign from Sydney mint

Bullion component

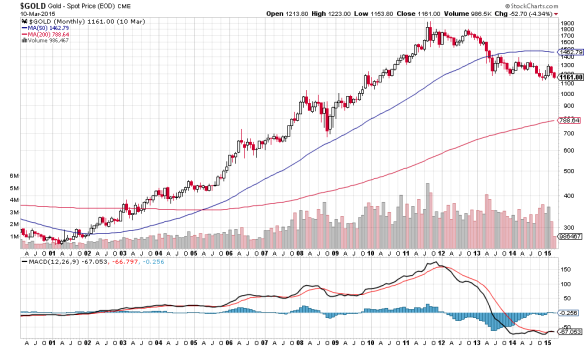

A bullion coin is a coin that has no numismatic or affection value and follows the exact value (less charges) of the underlying metal content, usually gold or silver. Investing in gold bullion is straightforward – if gold price goes up, gold bullion goes up, and vice versa. As much as holding gold is important for a diversified portfolio, it becomes unattractive when gold price goes down, like in 2013, or stays largely unchanged, like in 2014. On the back of the last 2 years investors are shunning gold and seem now to have forgotten its safe haven status.

Example of a bullion coin – the South African krugerrand

The gold price is often a reliable barometer of how equity markets and/or the US dollar are doing. When the equity markets are performing well and companies are paying dividends, investors are less interested in the gold market. On the other hand, when equity markets are doing well some of investors’ profit will stream in to alternative investments such as fine art, collectibles, coins etc., as investors seek to diversify.

Numismatic component

The collectable coin market has performed extremely well in the last 20 years. The emergence of online auctions coupled with improving logistics and global trade has brought an explosion of interest, especially in emerging markets such as Russia, China and Brazil.

The Knight Frank Wealth Report 2015 reported rare coins the No. 3 collectible in 2015 with a 13 % return, close after colletable cars (16 %) and fine art (15 %). Over a 10 year period rare coins have returned 232 % and over 5 years 92 %. See the Stanley Gibbons Rare Coin Index for British rare coins below. Note that the chart goes only to 2012, it would be considerably higher today.

While this market looks stronger than ever, one has to be aware of a potential top here. So how can we hedge against this possibility?

‘Collectable bullion’ – 2 flies in one!

Semi-numismatic gold coins have a bullion component that works like an insurance if the collectable coin market would decline. To understand why this is an insurance one has to realise, that for the coin and collectibles market to decline a wider down trend would have to materialise in the financial and equity markets, in which case the gold price would most likely go up considerably. On the news of the Lehman Brothers bankruptcy gold price went up by over 50 % in less than 6 months, August to November 2007. In the ensuing credit crunch and recession gold went from $830 to $1850 (over 230 %) in less than two years, January 2009- November 2011.

The numismatic and collectibles markets – together with financial markets – may enjoy several more years of good returns. As we all know (but tend to forget in the euphoria of a bull market) there will be a correction or downturn at some point. Finding investments that offer returns in both good and bad times are extremely hard to come by.

A great place to buy semi-numismatic gold is The Coin Cabinet Ltd, a power seller on eBay and an Amazon.com certified coin dealer.

Hope you enjoyed the article! Please comment below and follow me on twitter @AndreasAfeldt